- Bitcoin’s price drops amid strong US stock market, slipping from $66,436 to $64,544 as per CoinGecko data.

- German government’s sale of $65 million in Bitcoin to exchanges like Coinbase may be driving the crypto’s decline.

The price of Bitcoin has recently experienced a downturn, despite an otherwise strong performance by the U.S. stock market. This largest cryptocurrency by market capitalization fell to a low of $64,544 from a high of $66,436, as per the latest figures from ETHNews.

This decline in Bitcoin’s value coincides with substantial sales initiated by the German government, potentially explaining the cryptocurrency’s current underperformance.

UPDATE: German Government Still Selling BTC > $195M So Far.

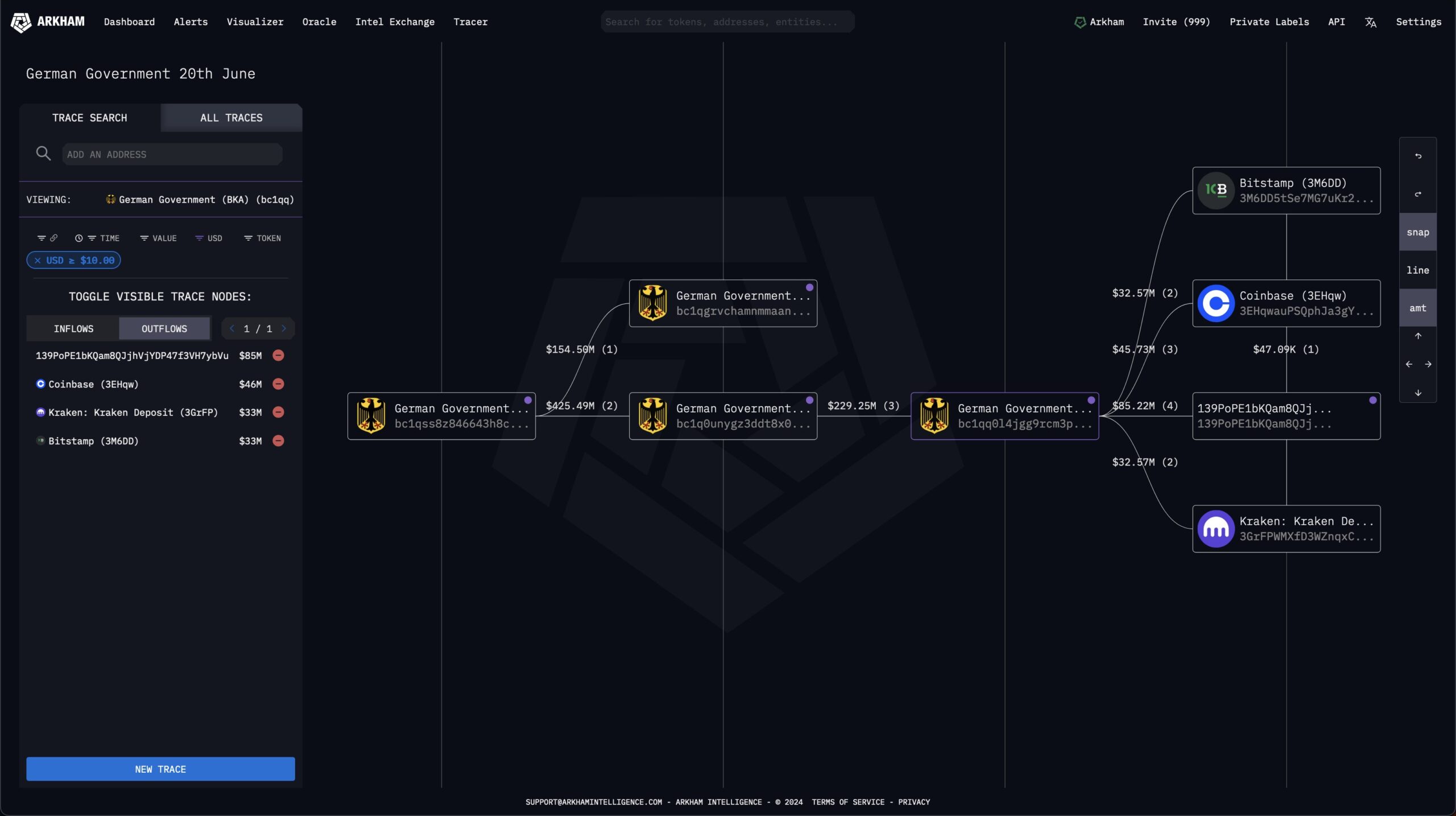

In the past 2 hours, the German Government sent $65M in BTC to 2 likely exchange deposits including Coinbase.

The German Government moved $600M BTC yesterday, sending $130M BTC to 4 likely exchange deposits including… pic.twitter.com/in2urlDBE0

— Arkham (@ArkhamIntel) June 20, 2024

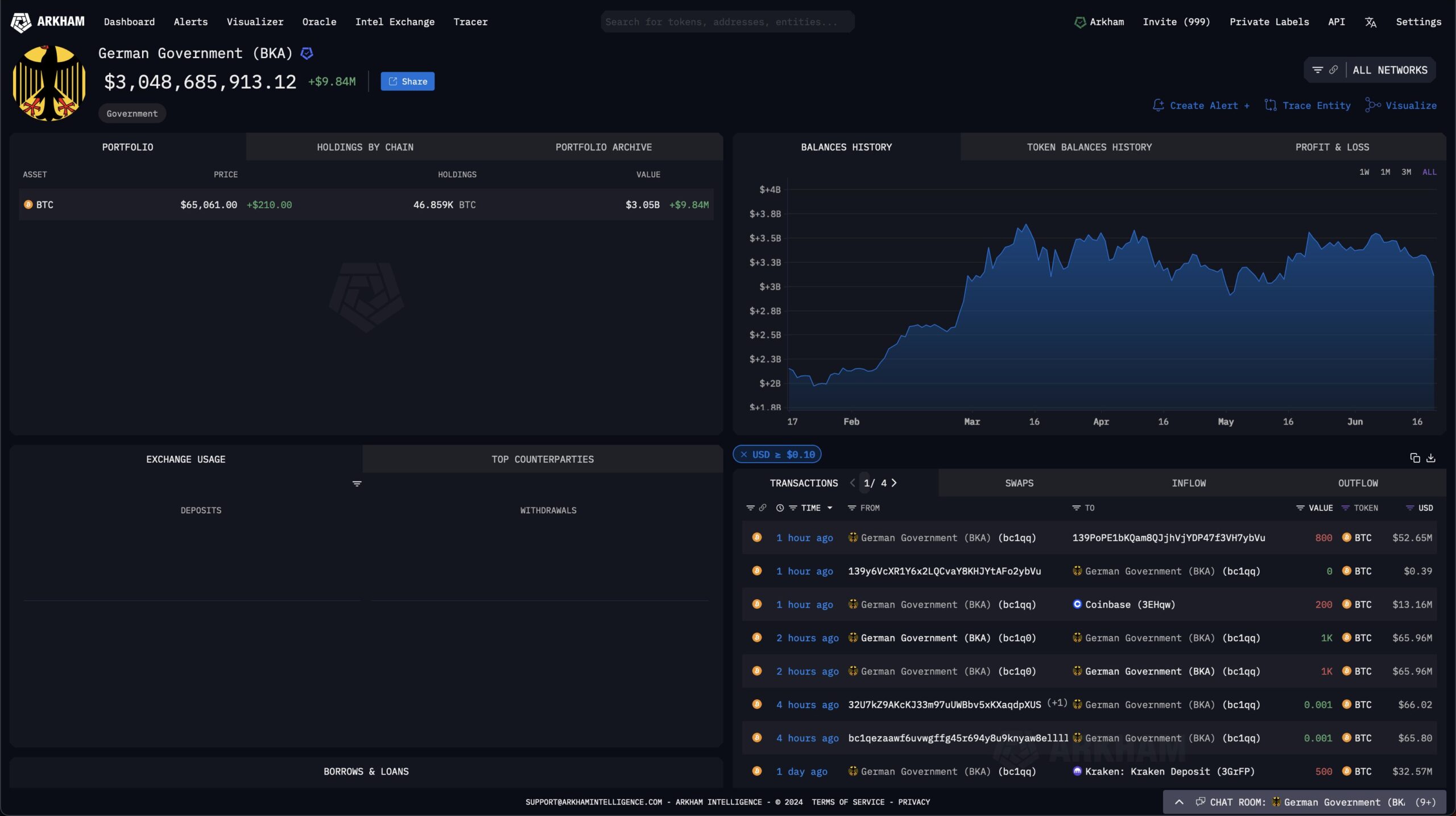

According to Arkham Intelligence, a data analytics platform, the German government has recently moved $65 million worth of Bitcoin to what are likely exchange accounts, including notable transactions to Coinbase.

Ki Young Ju, the founder and CEO of the on-chain analytics platform CryptoQuant, indicated that this selloff predominantly originated from Coinbase.

Furthermore, this is not an isolated incident, as the German government previously transferred $130 million worth of Bitcoin to various exchanges including Kraken and Bitstamp.

Despite these sales, the German government still possesses around $3.05 billion in Bitcoin, following a massive seizure of 50,000 Bitcoins from the defunct piracy website Movie2k.to in 2013.

While Bitcoin faces challenges, the U.S. stock market has shown robust performance, bolstered significantly by the surge in Nvidia’s stock value. The tech giant has reached a market capitalization of $3.4 trillion, surpassing the GDP of France and the entire market value of the crypto industry.

This has propelled Nvidia to become the world’s most valuable public company, driving the S&P 500 index briefly above 5,500 for the first time.

The dissonance between the thriving stock market and the flailing cryptocurrency prices is stark. Market analysts suggest that the U.S. Federal Reserve may cut interest rates before November, potentially offering a lifeline to the struggling cryptocurrency market.

A reduction in rates typically loosens monetary policy, which could provide a boost to cryptocurrencies like Bitcoin.