A large bitcoin options trade anticipates a shift from the present low-volatility regime to a period of heightened price swings, potentially exceeding the $53,000-$87,000 range. The trade saw the entity pay a net premium of over $1 million to purchase 100 contracts of the $66,000 strike call and put options expiring on Nov. 29, according to data confirmed by Lin Chen, head of business development Asia at Deribit. A long straddle is preferred when the market is expected to move far enough in either direction to make the call or the put option worth more than the cumulative premium paid. For the strategy to turn profitable and overcompensate for the premium paid, the bitcoin price needs to move either above $87,000 or below $53,000 by the end of November, Chen told CoinDesk.

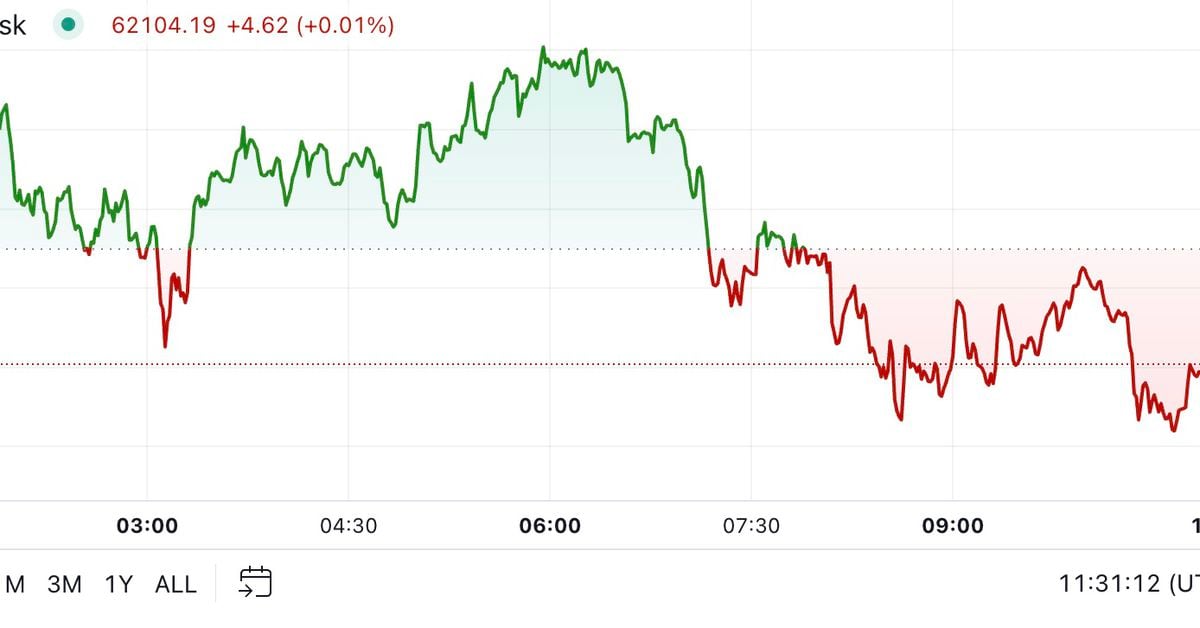

Crypto Market Muted After HBO Satoshi Reveal Falls Flat