- Dormant Bitcoin whale activates after five years, selling 301 BTC on Binance worth approximately $18.57 million.

- Investor retains 500 BTC valued at $34.58 million; potential realized profit from recent sales reaches $15.47 million.

- U.S. Federal Reserve cuts interest rates by 50 basis points, sparking nearly 5% increase in Bitcoin price.

A dormant Bitcoin whale has reactivated after five years, initiating a sale on the Binance trading platform, as reported by @OnchainDataNerd on X. This user, who previously acquired around 1,000 BTC from Huobi, has moved 301 Bitcoins to Binance, valued at approximately $18.57 million.

Five years earlier, this investor purchased 801 BTC for $8.25 million. As of now, they retain 500 BTC valued at $34.58 million, with an unrealized profit estimated at about $29.4 million.

7 hours ago, a 5 year-old $BTC holder 193EL deposited 301 $BTC (~$18.57M) to #Binance

If sold all at current price, his realized profit is $15.47M5 years ago, he accumulated 801 $BTC from #HTX for $8.25M

Just now, he still owns 500 $BTC (~$34.58M) with unrealized profit $29.4M pic.twitter.com/ammrS4KqRr

— The Data Nerd (@OnchainDataNerd) September 19, 2024

The recent transaction could net this investor a realized profit of $15.47 million, reflecting the appreciation in Bitcoin’s value over the interval.

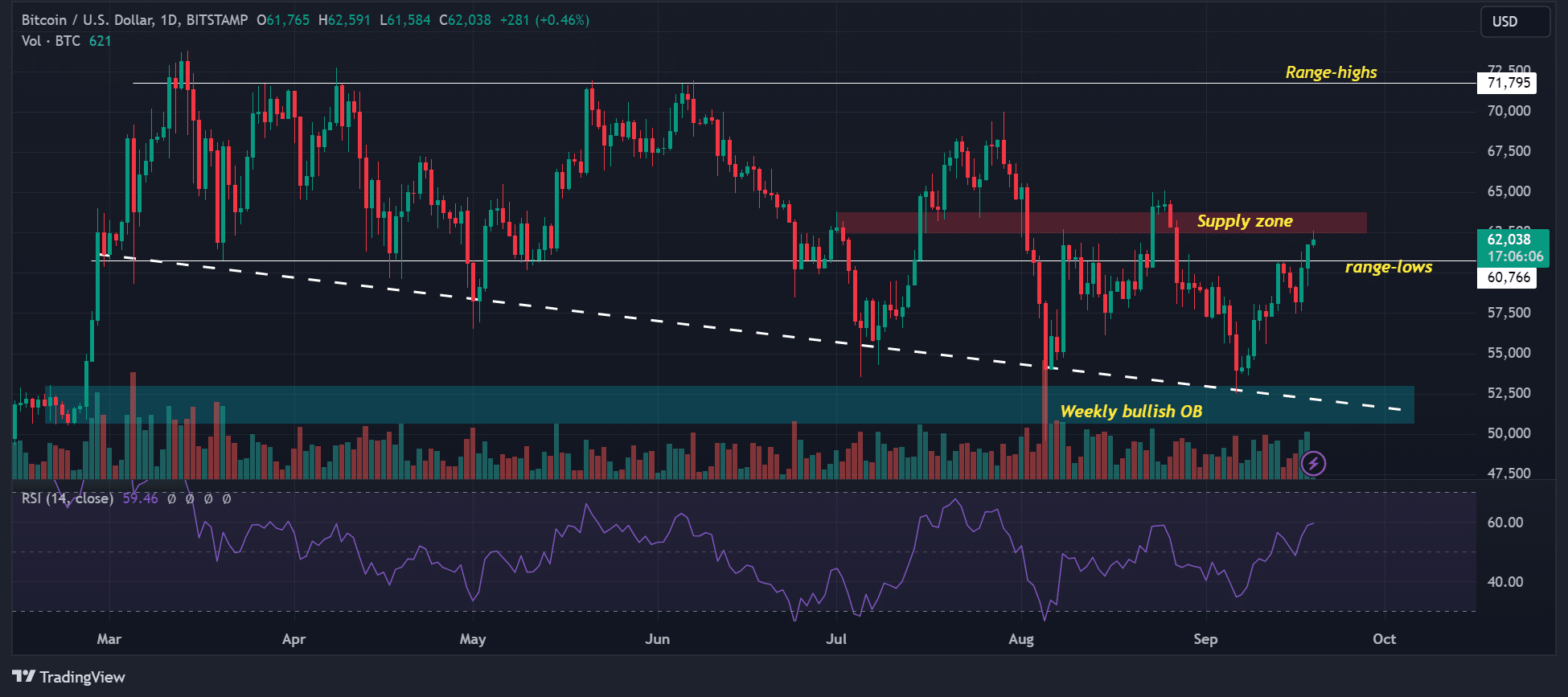

Bitcoin’s price has seen nearly a 5% increase in the last 24 hours

This rise coincides with the U.S. Federal Reserve’s unexpected decision to cut interest rates by 50 basis points, signaling a more dovish monetary policy aimed at maintaining low unemployment rates in a cooling inflation environment.

“In the short term, a 50 bps rate cut could signal to the market that the economy is slowing…However, over the long term, Bitcoin and other digital assets have historically thrived in low-interest-rate environments”.

This policy adjustment marks the beginning of a central bank easing cycle, potentially favorable for risk assets like Bitcoin.

The market’s reaction to the Fed’s aggressive rate cut has been mixed

Arthur Hayes, founder of BitMEX, described the rate cut as a “nuclear catastrophe for financial markets” suggesting it could indicate deeper problems within the global financial system.

The Fed cut, now all eyes are on BOJ meeting decision due this Friday.

Watch USDJPY like a hawk.

In the very short term:

$JPY weak = $BTC strong $JPY strong = $BTC weak

— Arthur Hayes (@CryptoHayes) September 19, 2024

Initially, asset prices might increase, but Hayes predicts a possible subsequent downturn.

Conversely, Mett Mena, Crypto Research Strategist at 21Shares, views the easing cycle as ultimately bullish for Bitcoin, particularly because it has historically performed well in low-interest-rate environments.

Concerns have also arisen due to the strengthening of the Japanese Yen against the U.S. Dollar, particularly following a significant sell-off in early August tied to the unwinding of carry trades.

Matthew Rowe, Head of Portfolio Management and Cross Asset Strategies at Nomura Capital Management in New York, described the market’s response to the Federal Reserve’s decision to cut interest rates by 50 basis points as initially positive, which then transitioned to cautiously optimistic as the announcement continued with a speech and Q&A session.

Rowe suggests that many market participants view this aggressive rate cut as unjustified by the visible market conditions, implying that the Fed might be reacting to negative factors not apparent to the general public.

This perspective could lead investors, who had entered the day with long equity positions anticipating to capitalize on this event, to engage in profit-taking, potentially driving the market lower as they try to discern the unseen concerns motivating the Fed’s preemptive actions.

The spike to $62,000 following the rate cut has triggered the liquidation of over $57 million in short positions, out of a total of $75.5 million, reinforcing a bullish sentiment in the Bitcoin futures market in the short term.

The current price of Bitcoin (BTC) is $62,847.16, with a 5.49% increase in the past hours. The daily range is between $61,609.87 and $63,290.30, and the 24-hour trading volume is $49.98 billion.