Having spoken with a number of industry participants, it’s clear to me that the large traders do not expect USDT to depeg. They tend to believe Tether Inc has more than enough assets to cover its liabilities, though there may be a duration mismatch – ie some of Tether’s assets may not be readily convertible into cash (I’ll use the word “cash” to mean bank account money in regular demand deposit accounts), so if all of Tether’s clients wanted to redeem their USDT for bank account dollars right now, there wouldn’t be enough to go around, and some folks would have to wait. To compare, retail banks typically cannot cope with customers wanting to withdraw more than 10{aa99edd08dd66036bd4af6c3dbe8af9b4ab31fcc55a521c2956d094a6dcd3a48} of their aggregate deposits electronically, and even less physically!

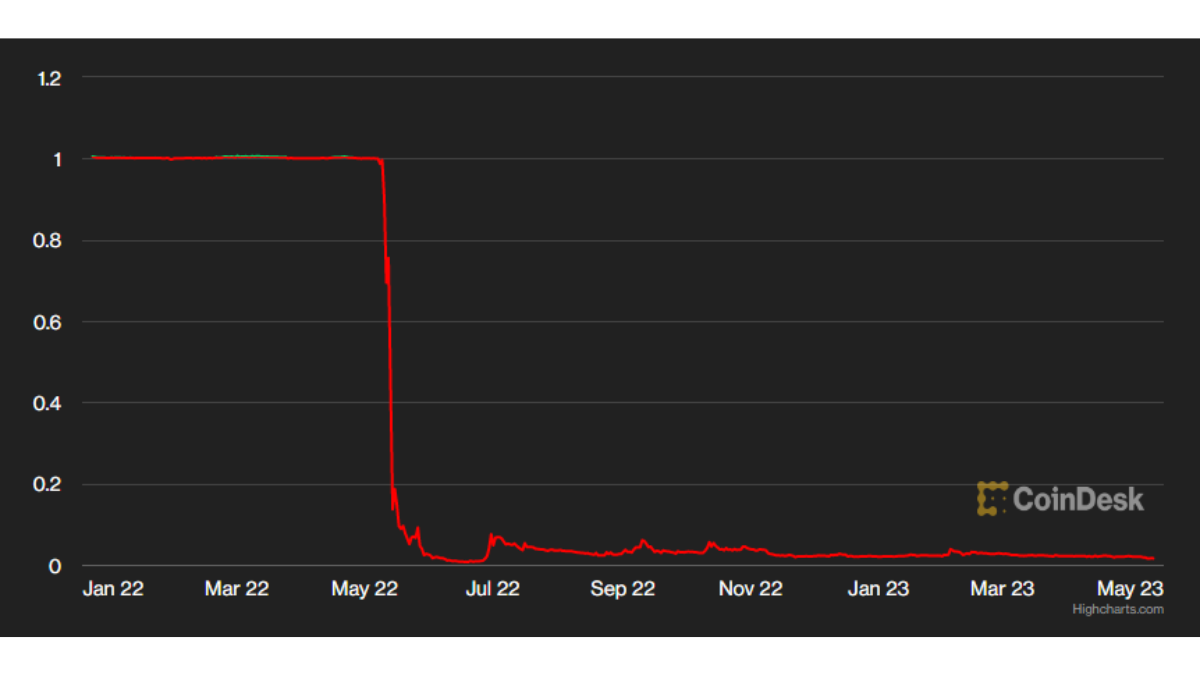

This piece isn’t about if USDT is fully backed or not, or what might make up the composition of its assets, it’s about what might happen if for some reason it did lose its peg.

How might USDT lose its peg?

The peg is maintained by Tether’s clients who are able to exchange between USDT and USD bank deposits at 1:1, less a small fee, versus Tether Inc. Note that not all USDT holders are clients of Tether. (for instance, I can hold USDT which I can get from exchanges, defi etc, but I am not a client of Tether).

If the market price of USDT falls below $1, clients can buy USDT in the market and redeem each USDT for 1 USD in the bank and make a profit on the difference. A depeg would only happen if Tether’s clients are unable or unwilling to buy and redeem USDT. This might happen if:

(1) they believe USDT is not fully backed (ie Tether doesn’t have enough money to give back to the redeemers) or

(2) they believe Tether’s assets exist but are illiquid AND its clients are unwilling to take on the duration risk by waiting a bit to have their USDT redeemed for USD.

What might happen if Tether loses its peg?

There are a few effects.

First, companies holding USDT on their balance sheet would see the value of their assets fall. Depending on how much of their balance sheet is in USDT, this could cause the company to fail. The second order effect here is that these companies may have to sell other assets (which may include cryptocurrencies) for USD to keep the business going, which could cause the price of those assets to fall.

Second, many “long-tail” (ie illiquid, smaller cap) crypto-assets will fall in value. They haven’t done anything wrong, this is just a consequence of market structure. Long-tail coins are typically priced against ETH or USDT (not USD) in their most liquid trading pairs, either because they trade in DeFi pools that were set up that way or because exchanges decided to list them that way (remember, Binance was original crypto-only and so listed coins against USDT rather than USD).

All else being equal, when the value of USDT falls, the value of these long-tail assets fall too. If you don’t intuitively get this, think about oil and USD – when USD falls, and the oil/USD price doesn’t change, the price of oil in your local (non-USD) currency also decreases. Or if you’re crypto native, then you intuitively know that when ETH falls, all the ETH-priced shitcoins fall too even they haven’t done anything wrong.

This could also cause a bit of pricing chaos if some data providers don’t differentiate between the USD price of an asset vs the USDT price (as the price in USDT of large cap assets should increase).

Third, and I think this is a small effect but it’s my favourite: speculators who have lent USDT as collateral to borrow cryptocurrencies (most likely to short them) may get margin called and their short positions may become liquidated causing a short squeeze and possibly pushing up the price of those crypto assets ?